10 ppm ULSD

Aviation Fuel

Including Oman, Yeman, UAE & Kuwait

Liquid Natural Gas

• ENERTRADE (Canada)

• ENERTRADE International (Barbados)

• Matterhorn LNG

• Niner Energy Limited

• Met Espano Energia SA (Spain)

Buyer: Vennwest Customer

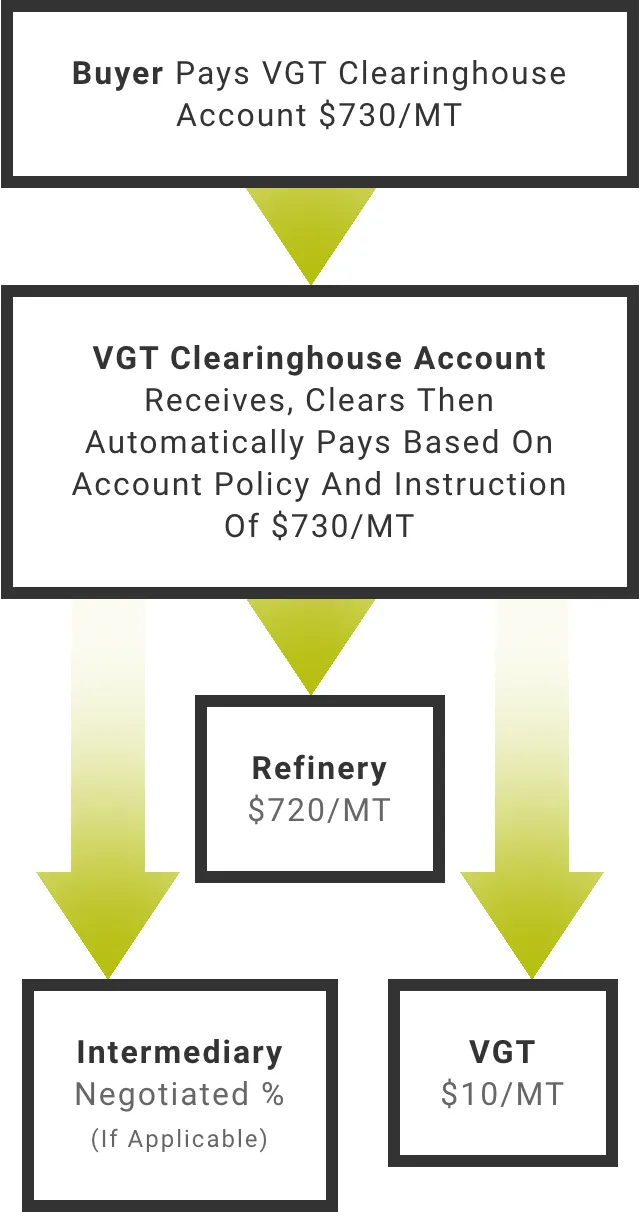

Clearinghouse:Trust Company-Vennwest

Intermediaries: TBA (If applicable)

Supplier: Refinery

Name Of Product: ULSD EN590

Monthly Quantity: 200,000MT

Product Cost: $720/MT

Commissions & Clearing: $10/MT

Buyer Cost: $730/MT

To learn more about our procedures, tools and processes please CONTACT US.

$720/MT

Negotiated %

(If Applicable)

$10/MT

ILOC AMOUNT

$500M USD Irrevocable Line Of Credit as required by all National Energy Companies (NEC’s).

DOCUMENTARY Letter Of Credit

By Vennwest & TD Canada Trust. VennWest to use subsidiaries, ENERTRADE (Canada) and ENERTRADE International (Barbados), as its operating entities.

Current Banking Institutions

National Bank, RBC, CIBC, BMO, Goldmans, MorganStanley, DeutscheBank, ING, ATB, Gabelli, TriWest, Clear North

USE OF FUNDS

To obtain leverage with primary producers (Public & National Energy Companies) to obtain allotments of product (e.g., LNG, JET-A1, D2&6 Diesel). Finance the purchase, resale, logistics, insurance and all intermediary costs to carry out commodity transactions. Transactions will be risk profile screened, vetted, & pre-negotiated. Vennwest will contractually have buyer/seller & proof of seller product and buyer funds prior to purchasing a commodity and transfer of title.

LINE OF CREDIT (ILOC, SBLC – DLOC)

Strengthens Vennwest’s position by covering transaction costs and/or credit worthiness for allotment assignment and storage facility rights.